Innovations in Forex Trading Software Development 1940416641

noviembre 10, 2025Innovations in Forex Trading Software Development

In the fast-paced world of finance, forex trading software developer Trading Vietnam has emerged as a significant player in the Forex trading market. As global financial markets become increasingly interconnected and technology-driven, the demand for advanced Forex trading software solutions has never been higher. Developers in this niche bear the crucial responsibility of developing applications that not only facilitate trades but also provide crucial data insights and features that can give traders an edge. In this article, we will explore the critical aspects of Forex trading software development, key technologies employed in the process, and emerging trends shaping the future of trading platforms.

The Role of Forex Trading Software

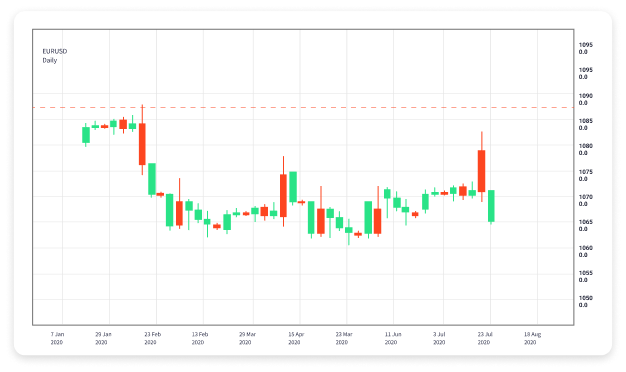

Forex trading software facilitates the buying and selling of currency pairs. It acts as the bridge between traders and the Forex market, providing user-friendly interfaces and advanced functionalities for market analysis. Traders utilize these platforms to analyze price movements, execute trades, and manage their portfolios effectively. A well-developed Forex trading software incorporates charting tools, real-time data feeds, risk management features, and automation capabilities, all aimed at improving traders’ operational efficiency and effectiveness.

Key Features of Successful Forex Trading Software

To succeed in the competitive Forex trading environment, software developers must ensure their platforms offer essential features, including:

- User-friendly Interface: A simple and intuitive design enhances the user experience, making it easier for traders to navigate the application and access necessary tools and information.

- Real-time Market Data: Access to real-time data ensures traders can make informed decisions based on current market conditions. This includes live quotes, currency pair trends, and economic indicators.

- Automated Trading Options: Algorithmic trading allows traders to set parameters for automated execution of trades, enhancing speed and accuracy.

- Robust Security: With the increasing prevalence of cyber threats, robust security measures such as encryption, two-factor authentication, and secure servers are paramount.

- Comprehensive Analysis Tools: Advanced charting tools, technical indicators, and customizable reports empower traders to analyze market trends effectively.

- Mobile Compatibility: As more traders prefer mobile devices for trading, ensuring that platforms are mobile-friendly is essential.

Emerging Technologies Shaping Forex Trading Software

The Forex trading landscape is continually evolving, driven by technological advancements. Here are some emerging technologies influencing software development:

Artificial Intelligence and Machine Learning

AI and machine learning are revolutionizing Forex trading software. These technologies analyze vast amounts of data to identify trends and make predictions, enhancing decision-making capabilities for traders. For example, AI-driven bots can personalize trading strategies based on historical data and real-time market movement.

Blockchain Technology

Blockchain technology is making strides in enhancing security and transparency in trading operations. By utilizing decentralized ledgers, Forex trading platforms can ensure secure transactions and track all trades in real-time, minimizing the chances of fraud and ensuring data integrity.

Cloud Computing

Cloud computing allows Forex trading software to operate seamlessly across multiple devices, enabling real-time data access and trading flexibility. Furthermore, it reduces the need for costly infrastructure by allowing developers to deploy applications over the cloud instead of on-premise servers.

Challenges in Forex Trading Software Development

While the opportunities in Forex trading software development are vast, several challenges must be navigated:

Regulatory Compliance

Forex trading is subject to a myriad of regulations that can vary significantly across jurisdictions. Staying compliant while developing software can be challenging and requires a thorough understanding of the legal landscape to avoid costly penalties.

Market Volatility

The volatile nature of Forex markets means that the software must be robust and capable of handling sudden influxes of data and trades. Developers must continuously optimize their applications to ensure uptime and reliability, even during high volatility periods.

Integration with Third-party Services

Forex trading software often needs to integrate with various third-party services such as payment gateways, news feeds, and economic calendars. Ensuring smooth integration without compromising performance can be a complex task for developers.

Future Trends in Forex Trading Software Development

As technology continues to evolve, so does Forex trading software development. Several trends are likely to shape the future landscape:

Increased Personalization

With AI backing, software developers are increasingly focusing on delivering personalized trading experiences. Traders can expect tailored recommendations, automated alerts, and custom dashboards that cater to their specific trading habits and strategies.

Enhanced User Support

Customer support will become more sophisticated, with the integration of AI chatbots capable of providing instant assistance and troubleshooting. This enhancement will improve user satisfaction and streamline support processes.

Expansion of Social Trading

Social trading functionalities, which allow traders to follow and copy the trades of seasoned professionals, are gaining popularity. Integrating features that facilitate collaboration and shared insights among traders will become increasingly common.

Conclusion

The landscape of Forex trading software development is ever-evolving, presenting both challenges and opportunities for developers. By understanding user needs and leveraging emerging technologies, developers can create robust, secure, and user-friendly platforms that enhance the trading experience. As we look to the future, the potential for innovation in this realm is boundless, promising a more seamless and intuitive trading experience for all participants involved in the global Forex market.